Best health insurance plans for expats in 2025: A Comprehensive Guide

Diving into the realm of health insurance plans for expats in 2025, this introductory paragraph aims to provide a captivating overview that will intrigue readers.

Detailing the key aspects and trends in expat health insurance, this paragraph sets the stage for an informative discussion ahead.

Overview of expat health insurance

Health insurance is crucial for expats living abroad as it provides financial protection and access to quality healthcare services in case of illness or injury. Without adequate coverage, expats may face significant out-of-pocket costs and limited healthcare options in their host country.

Key factors to consider when choosing health insurance

- Coverage area: Ensure the health insurance plan covers medical expenses in your host country and any other countries you may travel to.

- Cost: Consider the premium costs, deductibles, co-payments, and coverage limits to find a plan that fits your budget.

- Network of healthcare providers: Check if the insurance plan includes a network of hospitals, clinics, and doctors that meet your healthcare needs.

- Benefits and exclusions: Review the benefits covered, such as routine check-ups, prescription drugs, and emergency services, as well as any exclusions or limitations.

- Policy terms: Understand the policy terms, including waiting periods, pre-existing conditions, and renewal options.

Challenges expats may face in finding suitable health insurance plans

- Language barriers: Dealing with insurance policies and healthcare providers in a foreign language can be challenging for expats.

- Cultural differences: Health insurance systems vary from country to country, making it difficult for expats to navigate the complexities of the system.

- Legal requirements: Some countries have specific health insurance requirements for expats, which may impact the type of coverage they can obtain.

- Limited options: Expats in certain regions may have limited access to comprehensive health insurance plans that meet their specific needs.

Trends in health insurance for expats

Health insurance for expats is constantly evolving to meet the changing needs of this unique demographic. Let's explore some of the current trends in expat health insurance.

Features of traditional health insurance vs. innovative plans

Traditional health insurance plans for expats typically offer basic coverage for medical expenses, including doctor visits, hospital stays, and prescription medications. However, newer and more innovative plans are emerging to provide additional benefits and flexibility.

- Telemedicine services: Some modern expat health insurance plans offer virtual consultations with healthcare providers, allowing expats to access medical care remotely.

- Wellness programs: Innovative plans may include wellness initiatives such as gym memberships, nutrition counseling, and mental health support to promote overall well-being.

- Flexible coverage options: Unlike traditional plans with fixed benefits, newer expat health insurance plans may allow policyholders to customize their coverage based on individual needs and preferences.

Impact of global events on the future of expat health insurance

Global events such as pandemics, political changes, and economic fluctuations can have a significant impact on the landscape of expat health insurance. These factors may influence the availability, cost, and coverage options of health insurance plans for expats in the future

Key considerations for expats in 2025

When selecting health insurance plans as an expat in 2025, there are several crucial factors to prioritize to ensure comprehensive coverage and peace of mind. It's essential to consider coverage limits, exclusions, and the impact of telemedicine and digital health services on your insurance choices.

Factors expats should prioritize when selecting health insurance plans:

- Network coverage in the host country to access quality healthcare providers.

- Global coverage for medical emergencies, especially if travel is frequent.

- Policy flexibility to adjust coverage based on changing needs or circumstances.

- Inclusion of pre-existing conditions to avoid unexpected expenses.

- Coverage for mental health services, as expat life can be challenging.

- Options for family coverage to ensure loved ones are protected.

Importance of coverage limits and exclusions for expats:

- Understanding coverage limits prevents unexpected out-of-pocket expenses.

- Exclusions can vary between policies, so it's crucial to review them carefully.

- Knowing what is not covered helps in planning and budgeting for potential healthcare needs.

- Consider additional coverage or riders to fill gaps in the main policy.

How telemedicine and digital health services may influence expat health insurance choices:

- Telemedicine offers convenient access to healthcare professionals, especially in remote locations.

- Digital health services provide tools for monitoring health and wellness, promoting preventive care.

- Insurance plans with telemedicine benefits can enhance the overall healthcare experience for expats.

- Consider the availability and quality of telemedicine services when comparing insurance options.

Best health insurance plans for expats in 2025

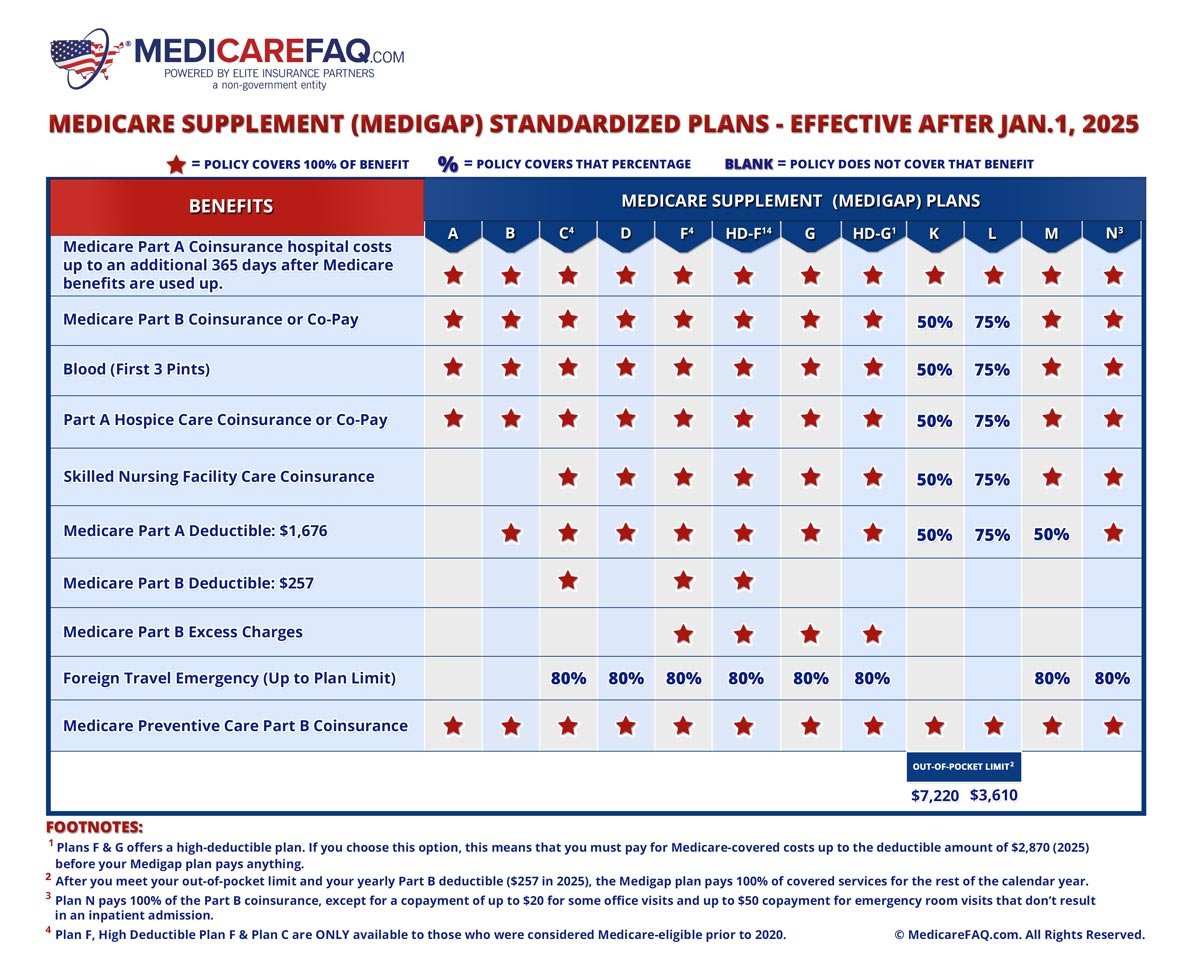

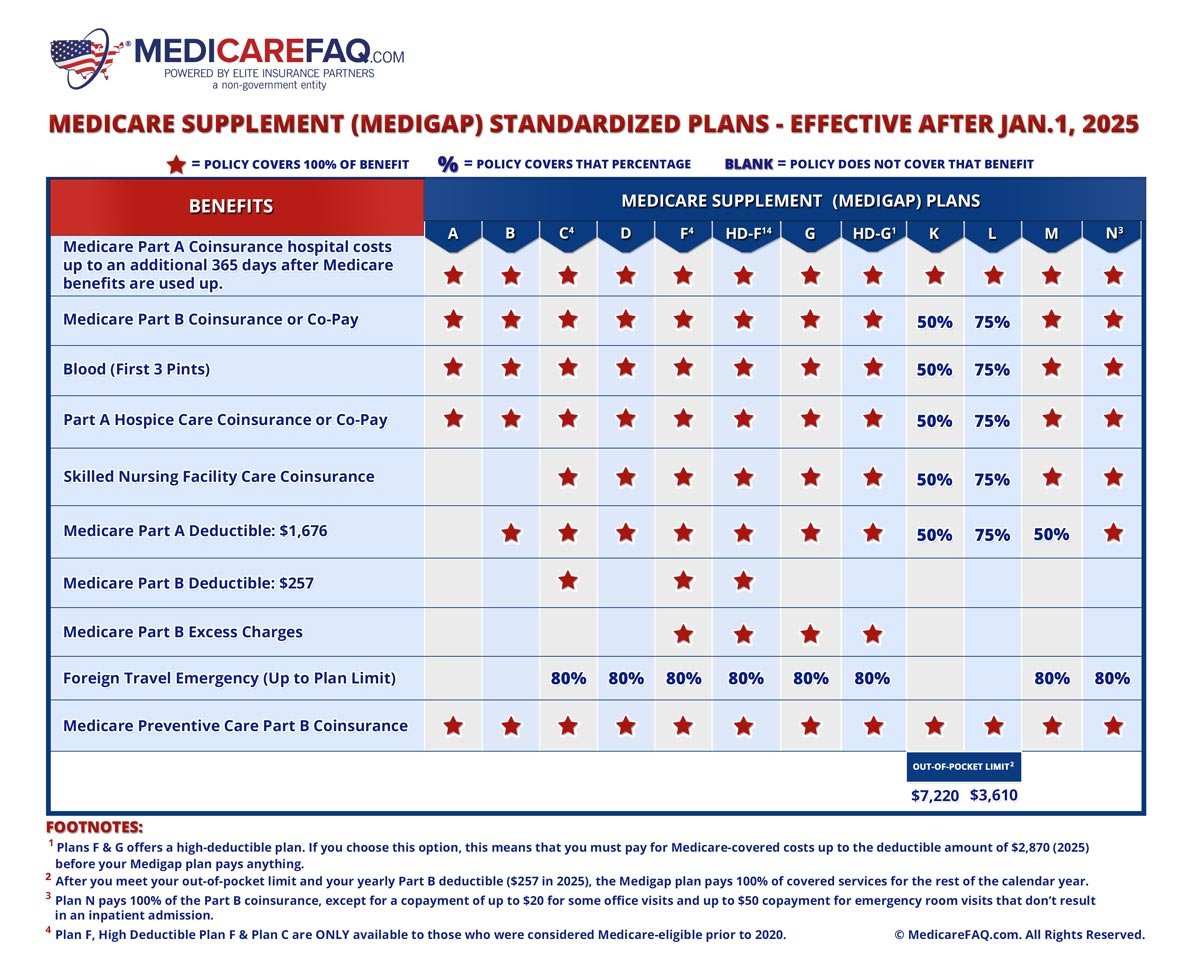

When it comes to choosing the right health insurance plan as an expat in 2025, it's essential to consider various factors such as coverage, cost, and benefits. Here, we have curated a comparison table of the top health insurance plans tailored for expats to help you make an informed decision.

Comparison Table of Top Health Insurance Plans for Expats

| Insurance Plan | Benefits | Drawbacks | Real-Life Scenarios |

|---|---|---|---|

| Plan A | - Comprehensive coverage- Global network of healthcare providers- Emergency medical evacuation | - High premiums- Limited coverage for pre-existing conditions | Beneficial for expats living in remote areas with limited access to quality healthcare services. |

| Plan B | - Affordable premiums- Telemedicine services- Coverage for wellness programs | - Restricted coverage for certain medical procedures- Limited network of healthcare providers | Ideal for expats who prefer virtual consultations and preventive healthcare measures. |

| Plan C | - Flexible coverage options- Tailored plans for different expat needs- Multi-language customer support | - Complex claim process- Higher out-of-pocket expenses | Suitable for expats with specific healthcare requirements and language preferences. |

Final Summary

Wrapping up our exploration of expat health insurance plans in 2025, this final paragraph summarizes the crucial points discussed and leaves readers with valuable insights.

FAQ Explained

What factors should expats prioritize when selecting health insurance plans?

Expats should prioritize coverage limits, exclusions, network coverage, and access to telemedicine services.

How do global events impact the future of expat health insurance?

Global events can affect policy coverage, premium costs, and the availability of specific health insurance plans for expats.

What are the key challenges expats face in finding suitable health insurance plans?

Expats often struggle with language barriers, understanding policy terms, and finding plans that cover their specific needs in different countries.